BLIK

A code to

make your life easier

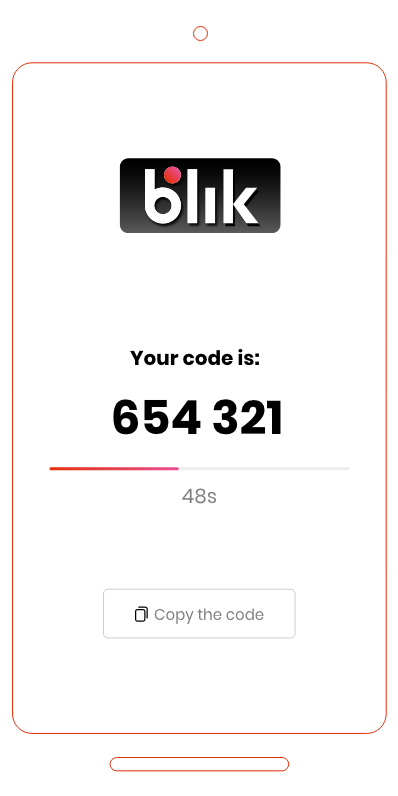

The BLIK code is a one-off, 6-digit code, which you will find in your bank’s application. It is valid for 2 minutes. After that time, you can generate a new one. You use the code to start your payment.

What do you need to pay with BLIK?

The bank’s app

BLIK is available in the apps of 19 banks

A phone

Any phone that can support your bank’s app

Internet access

An Internet connection e.g. through Wi-Fi or a mobile network

BLIK

One BLIK,

numerous possibilities

Benefit from solutions that will make your everyday life easier and gain precious time

BLIK

Without installation

You already have everything you need in your bank’s app

19 banks already support BLIK!

Convenient and fast

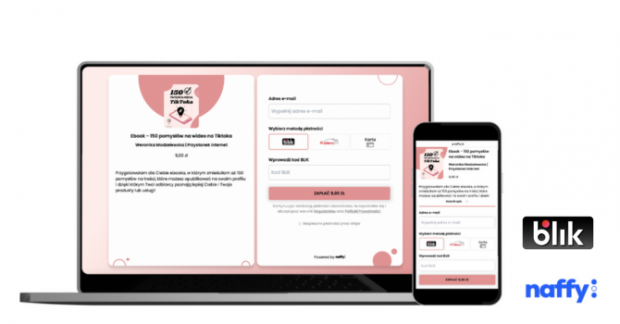

Pay quickly and conveniently online

BLIK is available in all online payment systems.

Always at hand

Buy in your favourite stores in Poland, using BLIK’s capabilities

BLIK is available in most physical stores

A phone with an app is enough

Use an ATM without a payment card

You will withdraw money with BLIK at these ATMs